How to Sell and Buy Your Home Simultaneously (Without the Stress)

How to Sell and Buy Your Home Simultaneously

(Without the Stress)

You're ready for your next home—but you're not leaving money on the table with your current one. Here's how to sell strong and buy smart at the same time.

For families in Greater Athens moving up to a larger home, better neighborhood, or different lifestyle, the stakes are high. You're sitting on equity you need for the down payment. You can't afford to lowball your sale or settle for the wrong house just to make timing work. And you definitely can't afford the stress of owning two homes, managing overlapping mortgages, or scrambling mid-move.

With the right strategy and someone who understands the coordination required, you can orchestrate both transactions to close in sync—keeping your move seamless, your finances clean, and your leverage strong.

“Timing and coordination become your superpowers.”

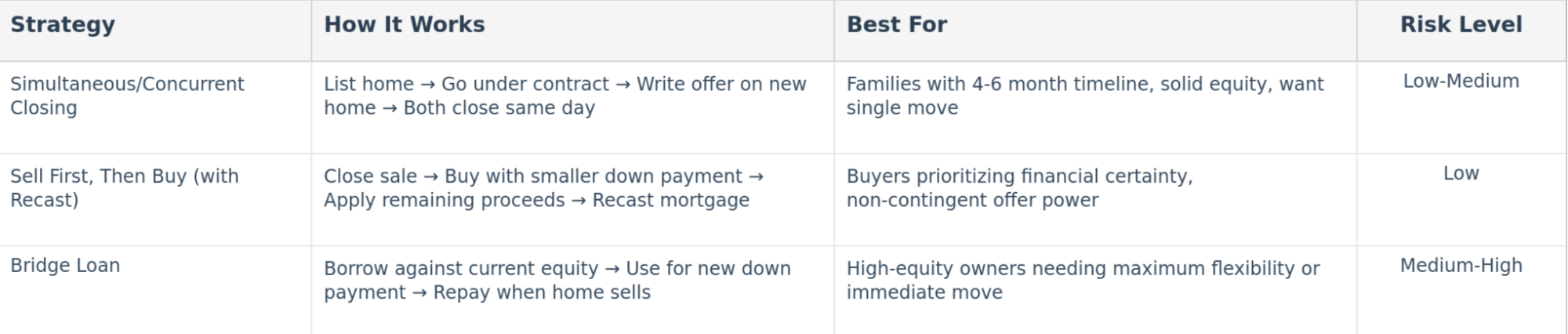

Three Strategies: Which Path Works for You?

Move-Up Real Estate Strategies Comparison

Not every move-up situation is the same. Market conditions, your timeline, equity position, and risk tolerance all matter. Here's what works in Greater Athens' current market (70–94 day median DOM).

Strategy #1: Simultaneous/Concurrent Closing—The Ideal Play

How It Works: List your current home → shop strategically while marketed → your home goes under contract → write an offer on your new home → both transactions close the same day or next day with the same closing attorney.

This is orchestration. It requires coordination, but it's the cleanest path for most families here.

Option A: Non-Contingent Offer (Strongest Position)

Your offer on the new home has no contingency tied to your current sale. You're presenting yourself as a buyer with immediate, certain funds.

When to Use This

- Your current buyer is locked in solid (strong credit, low debt-to-income, clear to close)

- You're competing in a multiple-offer situation

- You have sufficient equity to cover a gap if unexpected happens

- Target price range: $400K–$750K (typical multi-offer segment in Greater Athens)

Why This Wins: Sellers see zero risk. Your sale is already under contract with a real buyer and closing date. The seller of your new home knows your down payment is coming. This is the most powerful position in any negotiation.

The Reality Check: If your current buyer backs out (rare, but possible after inspection), you're temporarily carrying two homes. Mitigate this by ensuring your buyer is well-qualified before going non-contingent on the new purchase.

Option B: Settlement Contingency (Protected Position)

Your purchase is contingent on your current home actually closing by a specific date: "This offer is contingent on the sale and closing of [your address] by [date]."

When to Use This

- You want additional protection while staying competitive

- The market for your target home is balanced (less competition)

- You're a VA buyer managing entitlement timing or carrying-cost stress

- You prefer financial security over maximum negotiating edge

Why This Works: A settlement contingency is far stronger than a general "home sale" contingency because you show proof: your under-contract sale, completed inspections, appraisal status, realistic closing date. Sellers in balanced markets understand this is legitimate—you're not saying "I'll list my home after you accept my offer." You're a buyer with a locked-in sale already moving toward close.

The Advantage: Protection. If your current transaction hits a snag (inspection, appraisal shortfall, lender delay), you're not stuck signing documents on a home you might not afford. This is genuine leverage.

Why This Strategy Works: Our market has matured. Median days on market of 70–94 days means you have a realistic window to prepare, list, and get under contract before locking down your next home.

- Single move: Pack once, move directly. No temporary housing, no storage drama, no double moving costs.

- Funds flow directly: Sale proceeds fund your purchase. No dual mortgages.

- Strongest negotiating position: Whether Option A or B, your sale is locked in. This separates you from buyers making offers contingent on a future listing.

- Reduced stress and costs: One closing, one move, one timeline.

Best For: Families with a 4-6 month horizon, solid equity, and realistic expectations about the next purchase. This is the right strategy for move-up buyers who want orchestration, not chaos.

Strategy #2: Sell First, Then Buy (With Mortgage Recast—The Hidden Gem)

How It Works: Close on the sale of your current home → use proceeds for down payment and closing costs → move once.

The Mortgage Recast Option: If you need to move quickly after your sale closes but your dream home hasn't closed yet:

- Buy your new home with alower down payment (10–15% instead of 20%).

- Close the sale of your old home and receive proceeds.

- Apply that lump sum to the principalof your new mortgage.

- Ask the lender torecast the loan (not refinance)—your monthly payment drops immediately, without refinancing costs.

This works with most conventional lenders and only applies to conventional loans—VA, FHA, and USDA loans cannot be recast. The lender typically charges a small fee ($150-$500) and requires a minimum lump-sum payment (often $5,000-$10,000).

Pros: Financially safest. Know your exact proceeds before committing. Non-contingent offer power. No dual payments.

Cons: Two moves and temporary housing. Moving costs. Time pressure to find the next home.

Best For: Buyers prioritizing financial certainty or situations where a contingency would kill the offer.

📌 **Important for Veterans**: If you're using a VA loan to purchase, the recast option doesn't apply.

However, your sale proceeds still become instant equity—you just won't be able to lower the payment after closing without refinancing. This is why coordinating a larger down payment upfront (if you have liquid reserves) can be strategic.

Strategy #3: Bridge Loan (The Back-Up Play)

How It Works: Tap your current home's equity through a short-term bridge loan (6–12 months). Use those funds for the new home's down payment, then repay the bridge when your current home sells.

When to Use This: You need to move immediately, can't wait for your sale to close, or you're in a hyper-competitive market where any contingency kills your offer.

Real Talk: Bridge loans come with higher interest rates, strict underwriting, and tight timelines. You'll typically need good credit (680-740+, though requirements vary by lender), significant equity (20-30%+ recommended), and manageable debt-to-income. Because bridge lenders prioritize your property's value and equity position, a lower credit score may still qualify if your loan-to-value ratio is strong (under 70-80%). If your home takes longer to sell, you're carrying overlapping payments.

Best For: High-equity owners with strong income who need maximum flexibility or strongest possible offer immediately.

Want to see actual numbers for your situation?

Schedule a 15-minute strategy call and

I'll build a custom move-up timeline

with real proceeds estimates, payment scenarios, and coordination playbook.

Your 4-Phase Timeline

Phase 1: Financial & Strategic Prep (3–6+ Months Before Listing)

- Get professional home valuation and net sheet (estimated sale price, payoffs, closing costs, net proceeds).

- Meet with your lender for pre-approval with scenarios: sell first, buy while selling, carry two mortgages.

- Clarify moving goals: Why now? How long in the next home? Budget comfort zone?

- Choose an experienced agent who handles buy-sell combos—ideally the same agent for both sides.

This is where you set yourself up for smooth transition or a frantic one.

Phase 2: Home Preparation (60–90 Days Before Listing)

- Complete deferred maintenance: HVAC, plumbing, roof, exterior issues.

- Declutter and depersonalize. Professional staging increases offers and reduces DOM.

- Develop pricing strategy using solid Comparative Market Analysis (CMA). Overpricing backfires.

- Finalize curb appeal: landscaping, walkways, front door, shrubs.

First impressions and honest pricing determine how quickly you move.

Phase 3: Active Selling & Strategic Buying (Listing Launch Through Contract)

- List your current home with strong photography and online presence (Zillow, Realtor.com, social media).

- Begin shopping for your next home while your current home is marketed.

- Once your home receives an offer, begin writing on your target property.

- Coordinate timing: Current home under contract → New home under contract → Both move toward "clear to close."

The "Perfect Home" Contingency: If the absolute right property appears before your current home is under contract, there's a playbook. You and your lender adjust marketing/pricing strategy to accelerate. It's educated strategy, not reckless.

Phase 4: Closing Coordination (30–45 Days After New Contract)

- Get both transactions to "clear to close" status simultaneously.

- Final walkthrough on both homes (24–48 hours before closing).

- Coordinate with the same closing attorney. Schedule sale closing first (3–4 hour buffer minimum), then purchase.

- Wire transfers and funding happen in sequence. Pick up keys to the new home the day the old one transfers.

Why Same Attorney? A single closing professional managing both files catches conflicts, coordinates timing, and ensures funds move cleanly.

Coordination Playbook: Do's and Don'ts

Do's

✓ Get pre-approved early with multiple scenarios. Know your limits.

✓ Use the same agent and attorney for both transactions.

✓ Build buffer time between closings (3–4 hours minimum, never back-to-back).

✓ Confirm "clear to close" from all lenders before locking dates.

✓ Have backup plans for temporary housing and storage.

Don'ts

✗ Don't make large purchases or change jobs before closing. Lenders re-verify everything.

✗ Don't set same-hour closings with zero buffer. One delay cascades.

✗ Don't overprice your home hoping to "test the market." It extends DOM and weakens your position.

✗ Don't list before securing a HELOC if you're planning to use home equity.

For Our Veteran Clients: Critical Considerations

If you're using a VA loan to move up, three things change the playbook:

1. Reusing VA Entitlement

Many Veterans I work with are still paying off a VA loan on their current home or recently paid one off.

If you still have an active VA loan on your current home, you may be using partial entitlement. Your remaining entitlement determines how much you can borrow on the next home with zero down. We coordinate timing so your current VA loan payoff happens at or before your new purchase closing, restoring your full entitlement for maximum buying power. Veterans with full entitlement available have no VA loan limit—only lender underwriting capacity matters.

Why it matters: One day's delay in either closing can create a financing nightmare. We map this months in advance.

“One day's delay in either closing can create a financing nightmare.”

2. VA Loan Move-Up Math

Here's what makes VA loans powerful for move-up buyers:

- Zero down payment: VA loans cover 100% of the purchase price (no PMI).

- Funding fee: Typically 2.3% (rolled into the loan or paid at closing).

- Your sale proceeds become equity: Instead of using the sale for a down payment, that money becomes instant equity in the new home.

“Your sale proceeds become instant equity in the next home—

with zero down and no PMI.”

Real example: Veteran sells home for $320K (net $280K after payoff and closing costs). Purchases new home for $380K with VA loan (zero down). The $280K becomes instant equity, reducing the loan to $100K. That's dramatically different than a $304K mortgage.

3. Keeping Your Offer Competitive with Settlement Contingency

VA buyers often feel disadvantaged when offering contingent. Here's how we position you competitively:

- Show your buyer is locked in: If your current home is under contract, show the seller proof. Inspections complete? Appraisal ordered? Clear timeline to close? That's powerful.

- Offer a tight settlement contingency:"Contingent on sale of [address] closing by [date]"—not a vague "home sale" contingency.

- Bring financial strength: Strong credit, significant equity, pre-approval letter.

A well-coordinated VA offer—especially one showing a solid sale contract on your current home—is not a weak offer. It's a smart, organized offer from a well-prepared buyer.

Ready to Move Up the Right Way?

If you're a homeowner in Greater Athens—whether you're selling, buying, or doing both—let's talk strategy. I work with move-up buyers and Veterans exclusively on these dual transactions. I coordinate the whole process: prep, listing strategy, buying timeline, and closing coordination.

Let's start with a no-pressure conversation about where you are now and where you want to be.

Semper Fi. Honor. Courage. Commitment.

Timothy Carithers, REALTOR

Fidelis Home Partners | Real Broker

MRP, ABR, VA Loan Master Certified

GA License #404881